This update features policy, regulatory, legislative, and regional developments in Connecticut and New England. The policy updates are compiled by the CPES New Energy Professionals Team. If you are interested in learning more about the New Energy Professionals, the Policy Committee, or if you have ideas for future policy updates, we would welcome your input and feedback. Please send comments to Kathryn Dube, CPES Executive Director, via email: kdube@ctpower.org.

This week’s feature:

- New England’s Wholesale Electricity Markets Were Competitive in 2016

- Drift Is a New Startup Applying Peer-to-Peer Trading to Retail Electricity Markets

- Eversource Energy to Buy Aquarion in $1.68 Billion Deal

- PURA established a docket for the Application of The Southern Connecticut Gas Company to Increase Its Rates and Charges

- Sub. Sen. Bill 900 passed in both chambers over the weekend

STATE AND INDUSTRY DEVELOPMENTS

New England’s Wholesale Electricity Markets Were Competitive in 2016

The 2016 Annual Markets Report (AMR), issued by ISO New England’s Internal Market Monitor (IMM), concluded that New England’s wholesale power markets were competitive in 2016. The 2016 AMR covers the period from January 1 to December 31, 2016, and contains the IMM’s analyses of market operations and results.

The total value of the region’s wholesale electricity markets, including the cost of electric energy, capacity, ancillary services, and the cost of transmission services and upgrades, fell by about $1.7 billion, or 18%, from roughly $9.3 billion in 2015 to roughly $7.6 billion in 2016.

The total value of the region’s wholesale electric energy market in 2016 was $4.1 billion, which is 30% lower than the 2015 value of $5.9 billion. The 2016 electric energy market value was the lowest since 2003, when New England’s wholesale energy markets were launched in their current form. Over that same time period, the previous record-low market value was $5.2 billion in 2012

The decline in wholesale power prices mirrored a 34% year-over-year decline in the average price of natural gas, which is the fuel used most often to generate electricity in New England. Natural-gas-fired power plants produced 49% of the power generated in New England last year.

The full report is available on ISO New England’s website.

Drift Is a New Startup Applying Peer-to-Peer Trading to Retail Electricity Markets

The company is taking all the hottest tech in Silicon Valley and bringing it to New York’s retail energy market.

A Seattle-based startup is taking some of the most talked-about technology applications — machine learning, high-frequency trading, and peer-to-peer selling — and applying them to retail energy markets.

The 15-person company, called Drift, is attempting to change electricity delivery in deregulated markets by connecting consumers directly to energy producers on a cryptographically secure system (think blockchain), allowing it to granularly match a customer’s environmental or cost preferences.

Drift is made up of engineers who’ve worked at Amazon, Google and Microsoft; a data scientist from Argonne National Laboratory; a head of marketing from Uber; and a former FERC attorney.

Greg Robinson, the co-founder and CEO, said the platform was designed to “ruthlessly lower costs in the supply chain” and provide a more customized experience for people looking for energy choice.

Eversource Energy to Buy Aquarion in $1.68 Billion Deal

On June 2nd, The Hartford Courant reported that Eversource Energy had announced they had reached an agreement to buy Aquarion Water Co. for $1.68 billion, combining New England’s largest electric and gas utility with a dominant water company in Connecticut. MORE INFO

PUBLIC UTILITIES REGULATORY AUTHORITY NEW DOCKET:

On May 26, 2017, PURA established the following docket:

- Docket No. 17-05-42: Application of The Southern Connecticut Gas Company to Increase Its Rates and Charges (http://www.dpuc.state.ct.us/dockcurr.nsf/(Web+Main+View/All+Dockets)?OpenView&StartKey=17-05-42)

CONNECTICUT LEGISLATIVE UPDATE

Information about the Energy and Technology Committee, including committee meetings and public hearings, is available at: https://www.cga.ct.gov/et/

The Energy and Technology Committee’s JF deadline was March 23, 2017. The list of bills reported out of the Energy and Technology Committee is available at: https://www.cga.ct.gov/asp/menu/CommJFList.asp?comm_code=et and additional information about the status of these bills is available at: https://www.cga.ct.gov/2017/etdata/cbr/et.asp

Sub. Sen. Bill 900 passed in both chambers over the weekend. Below is the title of the bill and two links to find the language.

AN ACT CONCERNING MINOR REVISIONS TO ELECTRIC SUPPLIER COMPLIANCE REQUIREMENTS REGARDING ENVIRONMENTAL LAWS, RENEWABLE PORTFOLIO STANDARDS AND ADVERTISING AND CONTRACT PROVISIONS AND THE PUBLIC UTILITIES REGULATORY AUTHORITY’S REPORTING OF ELECTRIC RATES. https://www.cga.ct.gov/2017/FC/pdf/2017SB-00900-R000344-FC.pdf and https://www.cga.ct.gov/2017/amd/S/pdf/2017SB-00900-R00SA-AMD.pdf

CPES does not take a position on these legislative proposals; this is provided for informational purposes only to CPES members.

Jeffrey Gaudiosi opened the discussion with a look back at how energy was procured in the state of Connecticut after the electricity market deregulated in 1998. Deregulation allowed retail customers to choose a competitive supplier of electricity, but required the state’s electric distribution companies to continue to provide “Standard Service” and “Supplier of Last Resort Service” to customers who did not choose a competitive supplier. He explained that the legislature dictated how electricity was procured for these customers, requiring the utilities to employ a three-year laddering model for Standard Service power procurements. This procurement method involved a series of overlapping wholesale contracts extending over several years, which kept retail electricity prices relatively stable for consumers. This method worked well for many years, Gaudiosi explained, but fell out of favor when Standard Service rates reached record levels and prevented retail customers from taking advantage of declining wholesale electricity prices in the 2009-2010 timeframe.

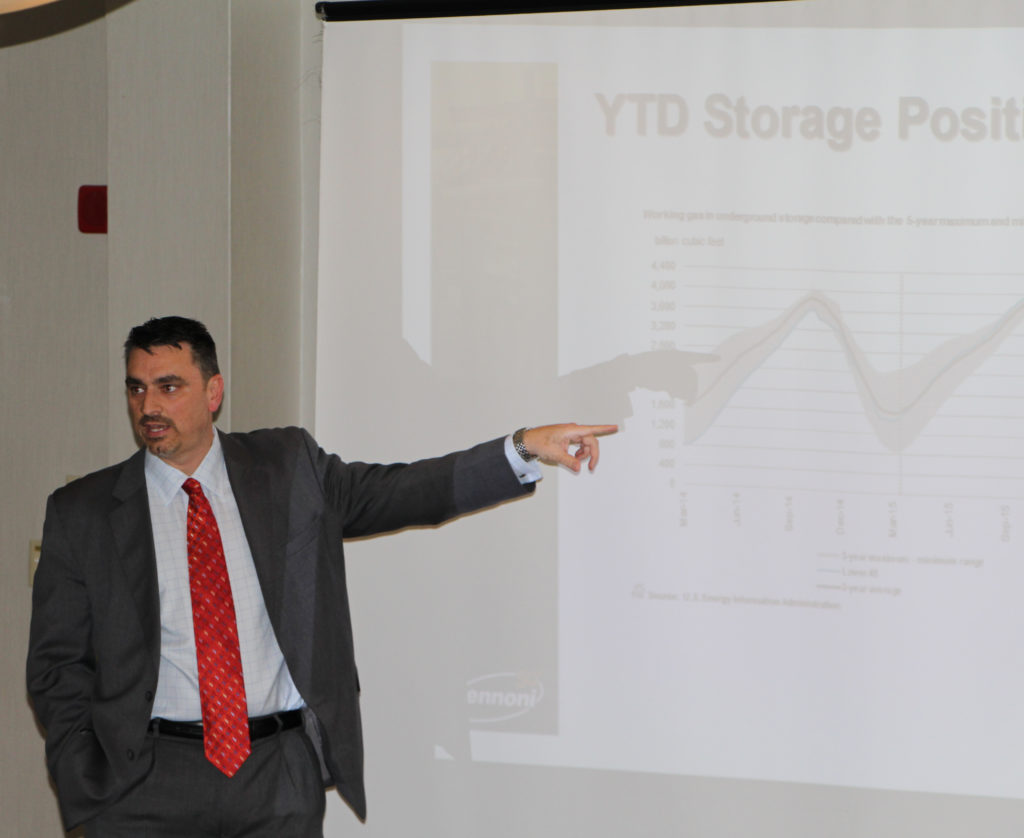

Jeffrey Gaudiosi opened the discussion with a look back at how energy was procured in the state of Connecticut after the electricity market deregulated in 1998. Deregulation allowed retail customers to choose a competitive supplier of electricity, but required the state’s electric distribution companies to continue to provide “Standard Service” and “Supplier of Last Resort Service” to customers who did not choose a competitive supplier. He explained that the legislature dictated how electricity was procured for these customers, requiring the utilities to employ a three-year laddering model for Standard Service power procurements. This procurement method involved a series of overlapping wholesale contracts extending over several years, which kept retail electricity prices relatively stable for consumers. This method worked well for many years, Gaudiosi explained, but fell out of favor when Standard Service rates reached record levels and prevented retail customers from taking advantage of declining wholesale electricity prices in the 2009-2010 timeframe. David Ferro rounded out the discussion with a look at how consultants and brokers are changing their power procurement strategies based on what is happening in the marketplace. He highlighted natural gas storage volumes as one of the primary drivers of wholesale electricity prices in the U.S. In New England, he pointed to increasing capacity and transmission costs impacting wholesale electricity prices, and discussed the significant turnover in the generation fleet away from coal- and oil-fired generation toward natural-gas fired generation. This, he said, will put additional pressure on the natural gas infrastructure serving the region, which can have a significant impact on wholesale electricity prices. He concluded with a list of seven steps for developing an energy supply strategy – for facility managers, supply chain professionals, and those involved in managing energy procurement strategies. Technology advancements, he said, will be extremely important in creating a “sustainable energy community” where consumers have more control over their energy supply.

David Ferro rounded out the discussion with a look at how consultants and brokers are changing their power procurement strategies based on what is happening in the marketplace. He highlighted natural gas storage volumes as one of the primary drivers of wholesale electricity prices in the U.S. In New England, he pointed to increasing capacity and transmission costs impacting wholesale electricity prices, and discussed the significant turnover in the generation fleet away from coal- and oil-fired generation toward natural-gas fired generation. This, he said, will put additional pressure on the natural gas infrastructure serving the region, which can have a significant impact on wholesale electricity prices. He concluded with a list of seven steps for developing an energy supply strategy – for facility managers, supply chain professionals, and those involved in managing energy procurement strategies. Technology advancements, he said, will be extremely important in creating a “sustainable energy community” where consumers have more control over their energy supply.